A major trading platform saw the rise of fee-free investment apps like Freetrade, Robinhood, and Revolut as an opportunity to attract a new type of customer: young people. The challenge was to help the company–who to this point catered only to "rich retired dentists"–to understand a new customer and design a compelling proposition which would win against established competitors.

Because this was an entirely new customer, I built this 8 week project around three rounds of quant and qual research with US and UK investors. To boost our clients' immersion in this customer group, I invited them to join our qual interviews and shared edited videos to summarise the output.

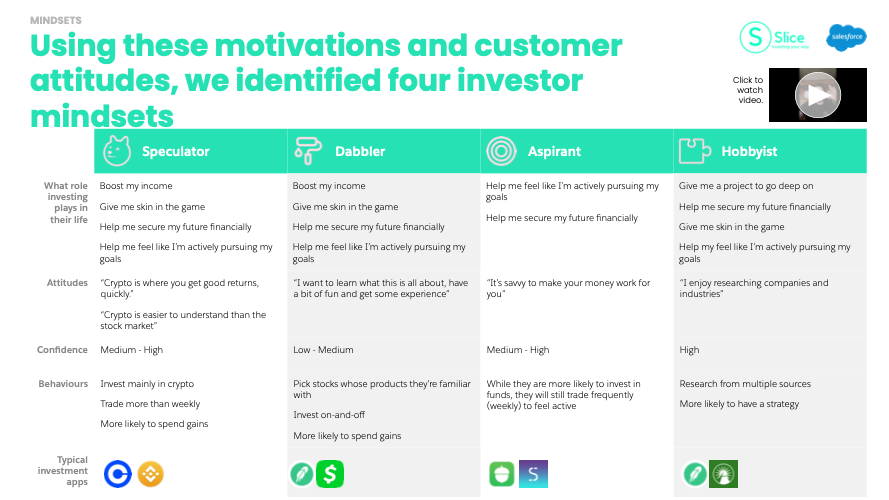

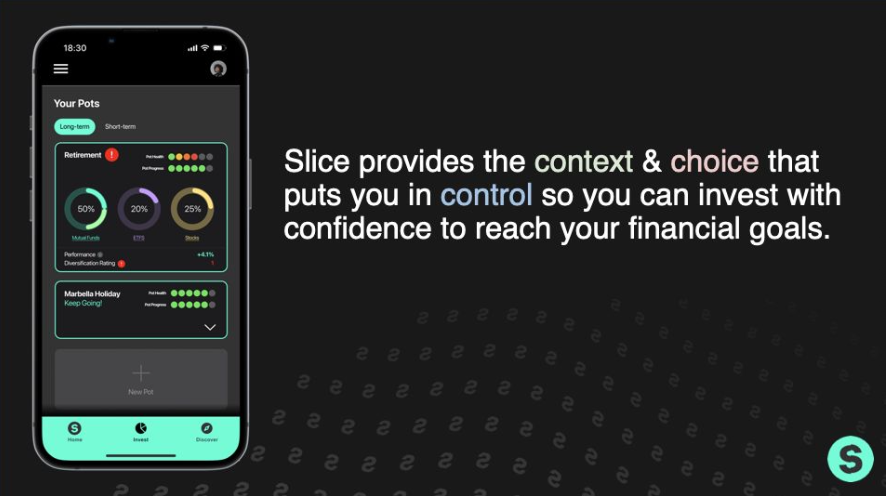

From the first two rounds of research we identified four investor mindsets. Our first insight was that while two of these mindsets had clear financial goals, the current crop of apps don't help them invest towards them. We also found that due to this lack of investing strategy, they felt overwhelmed by choice and lacked confidence in their decisions, leading them to give up quickly or to feel like they should be constantly trading.

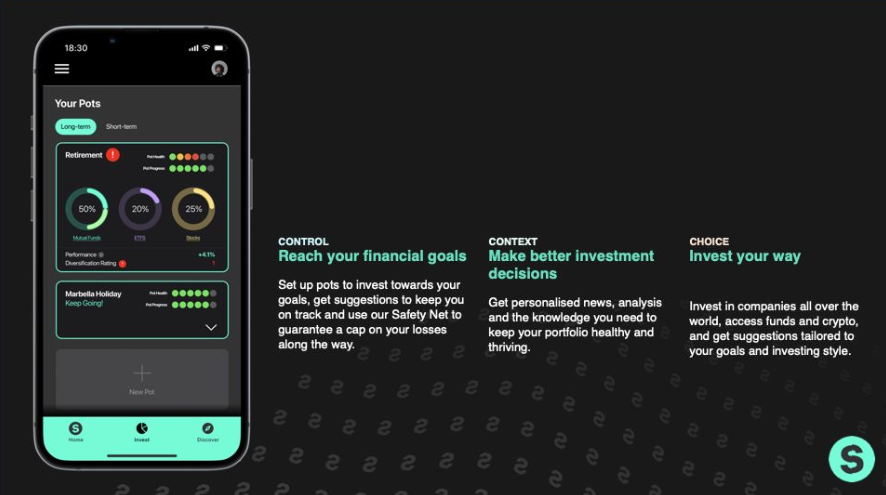

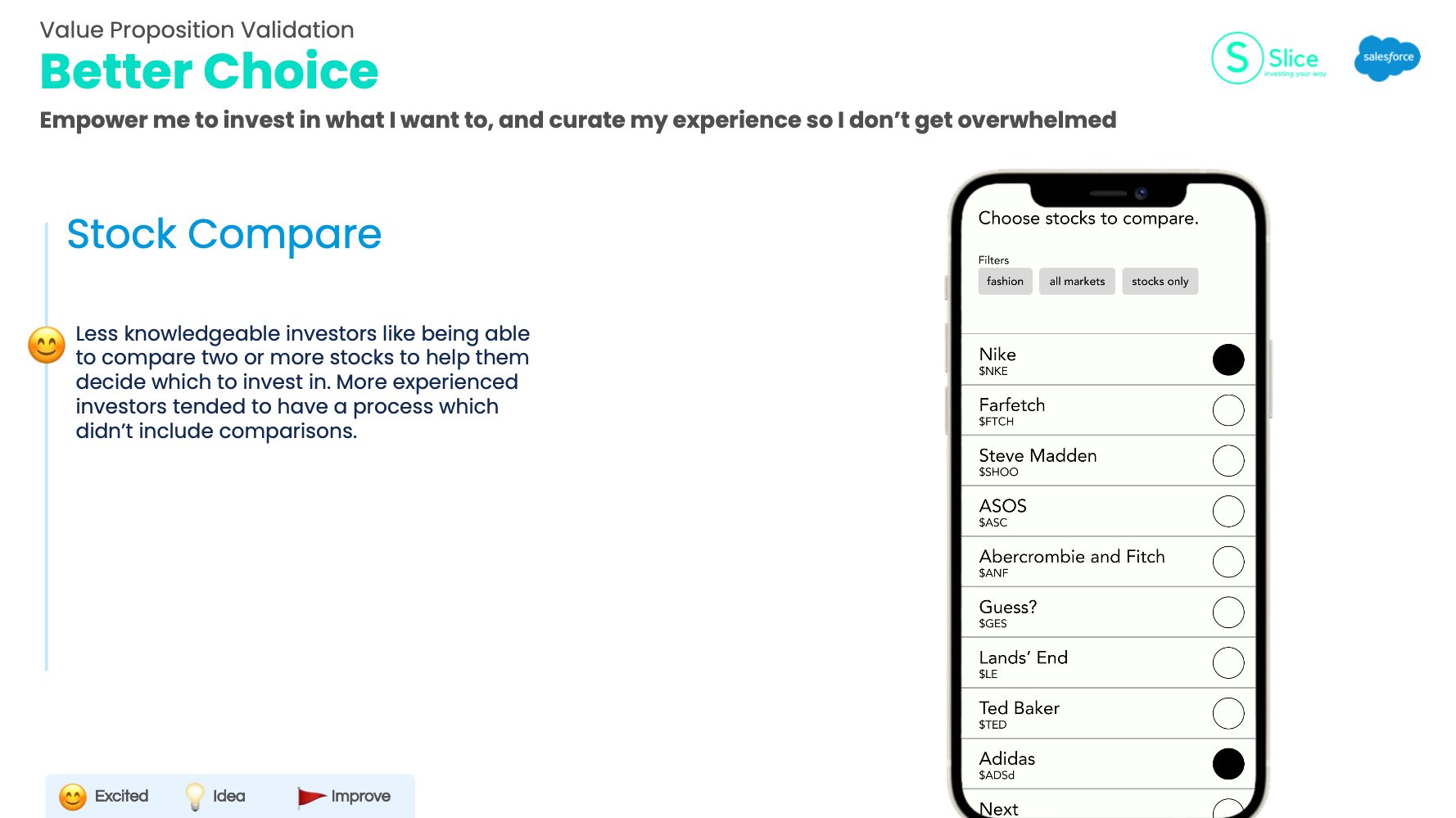

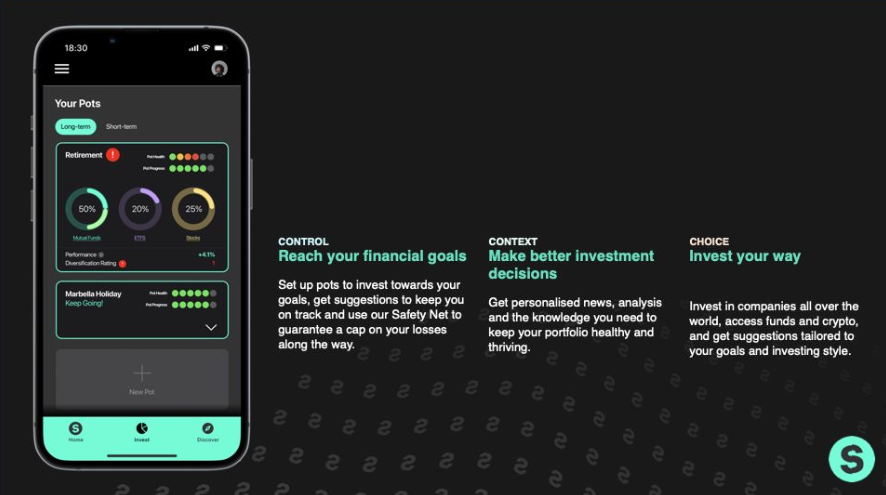

These insights became the fuel for two idea generation workshops at either end of a week of proposition development. With our broad direction established we developed prototypes of features and tested their usefulness with 12 of our target investors. (Note: due to resource constraints I built the screens.)

One key lesson was that while every investor claimed to want to learn more about investing, none of them made use of any of the resources currently available to them. Digging into the behavioural psychology literature, I identified 'self-handicapping' as the reason for this behaviour, an excuse in the case of poor performance. Actually learning how to invest means people wouldn't be able to justify losses to themselves as a consequence of, 'I don't know what I'm doing'. This insight meant we steered away from an early hypothesis to focus on educational features and content and instead focused on ways to drip-feed learning as people used the app.

The project successfully secured funding from the client board and the app is currently in development. It also strengthened the partnership between Salesforce and the client, contributing to the successful close of a £3 million Salesforce Enterprise License Agreement.